Toronto Real Estate TREB Published April, 2019 Resale Market Figures

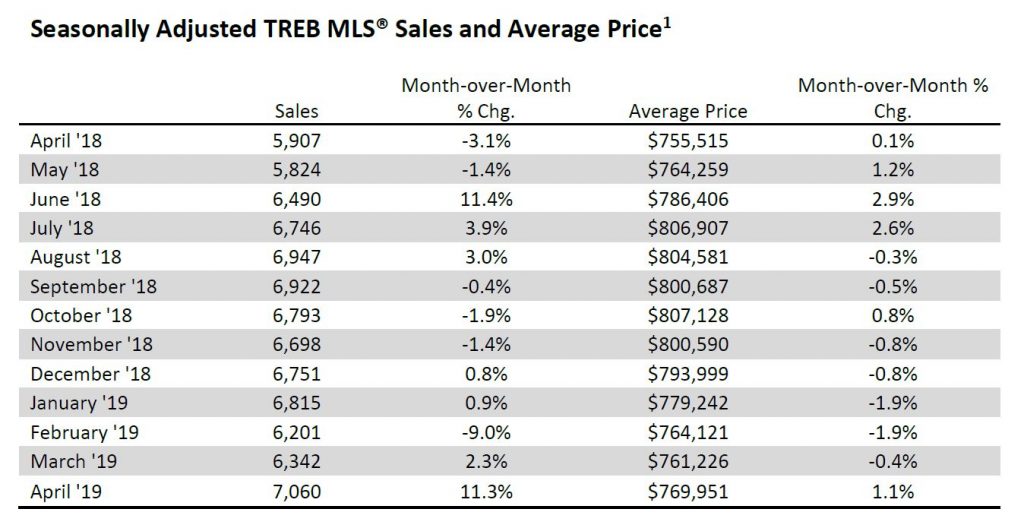

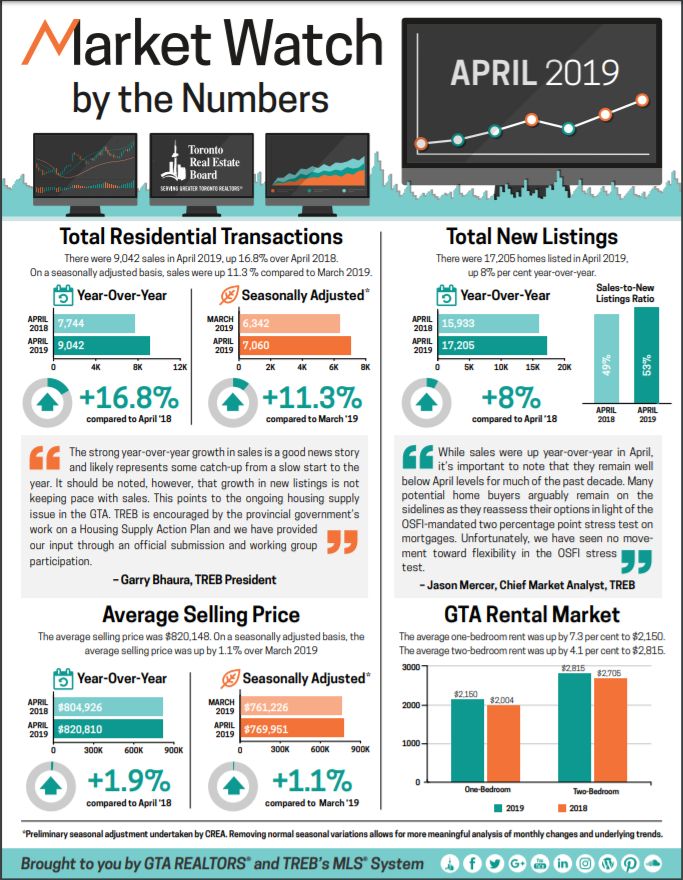

TREB announced that the Greater Toronto Area REALTORS® reported a substantial year-over-year increase in home sales in April 2019. The number of residential transactions jumped by 16.8 per cent to 9,042 compared to 7,744 in April 2018. On a preliminary seasonally adjusted basis, sales were up 11.3 per cent compared to March 2019.

New listings were also up year-over-year by eight per cent. However, the annual growth rate for new listings was much lower than that reported number for sales. This suggests that market conditions continued to tighten which points toward perhaps an expected acceleration in price growth.

“The strong year-over-year growth in sales is obviously a good news story and likely represents some catch-up from a slow start to the year 2019. TREB’s sales outlook for 2019 anticipates an increase relative to 2018.

It should be noted, however, that growth in new listings is not keeping pace with sales. This points to the ongoing housing supply issue in the GTA. In this regard TREB welcomes the provincial government’s Housing Supply Action Plan announced to reduce red tape and improve the mix of housing types. TREB provided input on the Plan through submissions and participation on working groups,” said Mr. Bhaura.

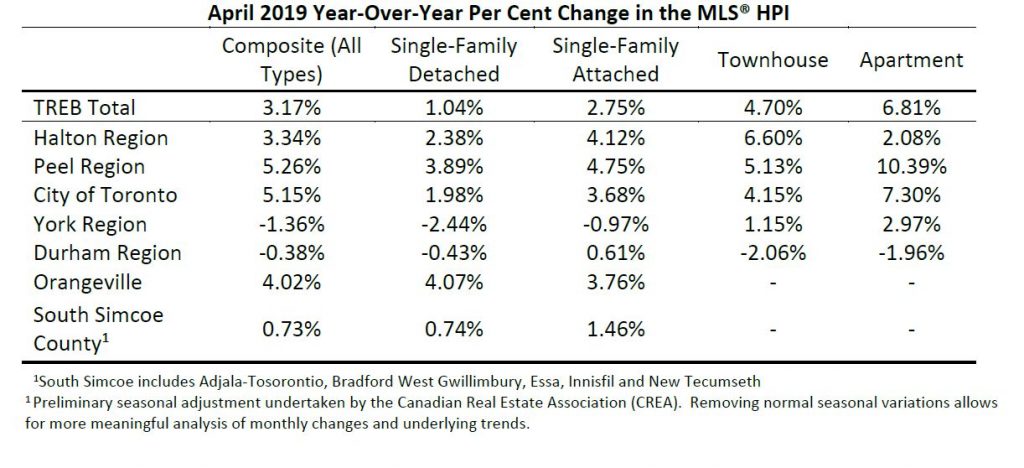

The year-over-year rate of price growth generally edged up in April, 2019 relative to the first three months of the year in 2019. The MLS® HPI Composite benchmark was up by 3.2 per cent – the highest rate of growth in more than a year. The average selling price was up by 1.9 per cent to $820,148, representing the strongest annual rate of growth so far in 2019. On a preliminary seasonally adjusted basis, the average selling price was also up by 1.1 per cent compared to March 2019.

Max’s humble comment:

During the last ten years, almost every year there is an acute shortage of listings in January, February and March. So there are more qualified buyers trying to buy houses and to stay ahead of the incoming spring market that the available saleable listings. So, more competition among the buyers raises the buyers’ prices. After more and more listings come into the market in the spring months, the home prices tend to decrease somewhat in June, July and afterwards.

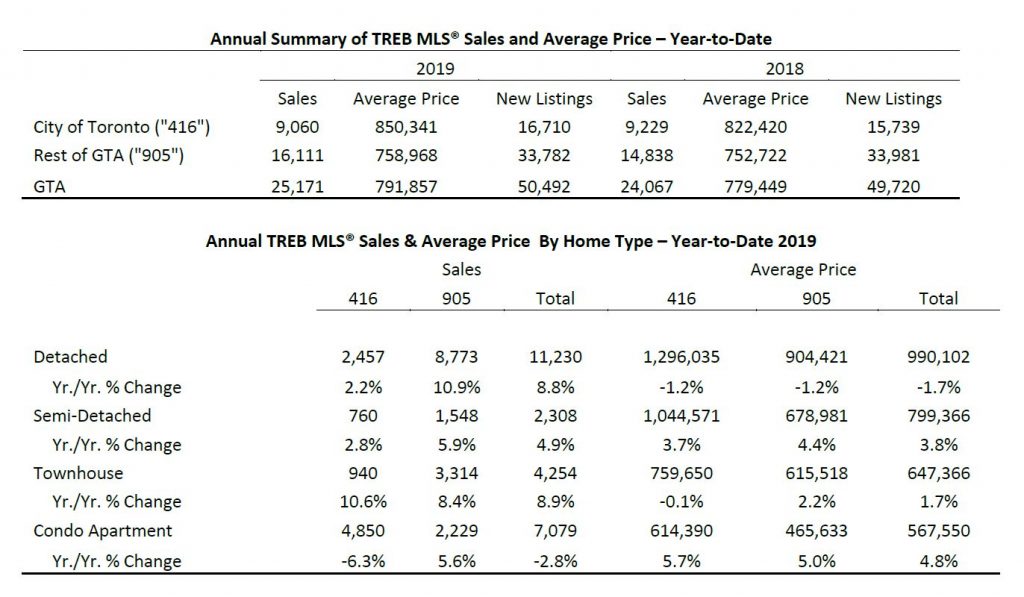

Price growth continued to be driven by the condominium apartment segment and higher-density low-rise segments. The average price for detached houses dipped year-over-year, specifically in regions surrounding the City of Toronto. The detached market segment, with the highest price point on average, has arguably been hardest hit by measures such as the OSFI stress test.

The sales were up year-over-year in April, 2019, Although many potential home buyers arguably remain on the sidelines as they reassess their options in light of the OSFI-mandated two percentage point stress test on mortgages. Longer term borrowing costs have trended lower this year in 2019 and the outlook for short-term rates, for which the Bank of Canada holds the lever, is flat to down this year.

Tight market conditions in the condominium apartment rental market remain in place. Year-to-date (January 2019 through April 2019) condominium rental transactions for one-bedroom and two-bedroom apartments were up by 10.2 per cent and 9.7 per cent respectively compared to the same period in 2018.

Average year-to-date rents for one bedroom apartments were up by 7.3 per cent on an annual basis to $2,150. Over the same period, two-bedroom apartment rents were up by 4.1 per cent to $2,815.

The supply of ownership and rental housing is of paramount importance to the GTA, from the perspective of affordability and economic competitiveness of the region. More higher income and talented people are more likely to move to the region if they can easily find housing that meets their needs and within their budgets.

With this in mind, it is also important to think about housing supply through the lens of public transportation. TREB has been highlighting the important links between housing and transportation for a number of years, including through research conducted for TREB by CANCEA and the Pembina Institute dealing with transportation infrastructure’s impact on affordability and transit supportive development respectively. TREB will continue research in these areas moving forward.

Summary of TREB MLS® Sales and Average Prices

Source: Toronto Real Estate Board

Thinking to sell your house or Condo in Central Toronto areas and/or in downtown Toronto areas? Please call, text or email Max Seal, Broker at 647-294-1177. Please visit http://www.TorontoHomesMax.com for a FREE Home Evaluation“.

Thinking to buy a House or Condo in Central Toronto areas and/or in Downtown Toronto areas? please call or text Max Seal, Broker at 647-294-1177 to buy your dream home or Condo. I offer you a 30-min “FREE buyer’s consultation” with NO obligation.

Please visit my website http://www.centraltorontorealestate.com/ to find out available homes and Condos for sale in Central Toronto areas and/or in downtown Toronto areas.

This Toronto housing market may be a better time for “Move-up”, “Move-down” or “Empty-nester” Sellers and Buyers. Want a “Market Update” of your home in 2019? Please click the image below or call or text Max Seal, Broker at 647-294-1177 or send an email.

Leave a Reply