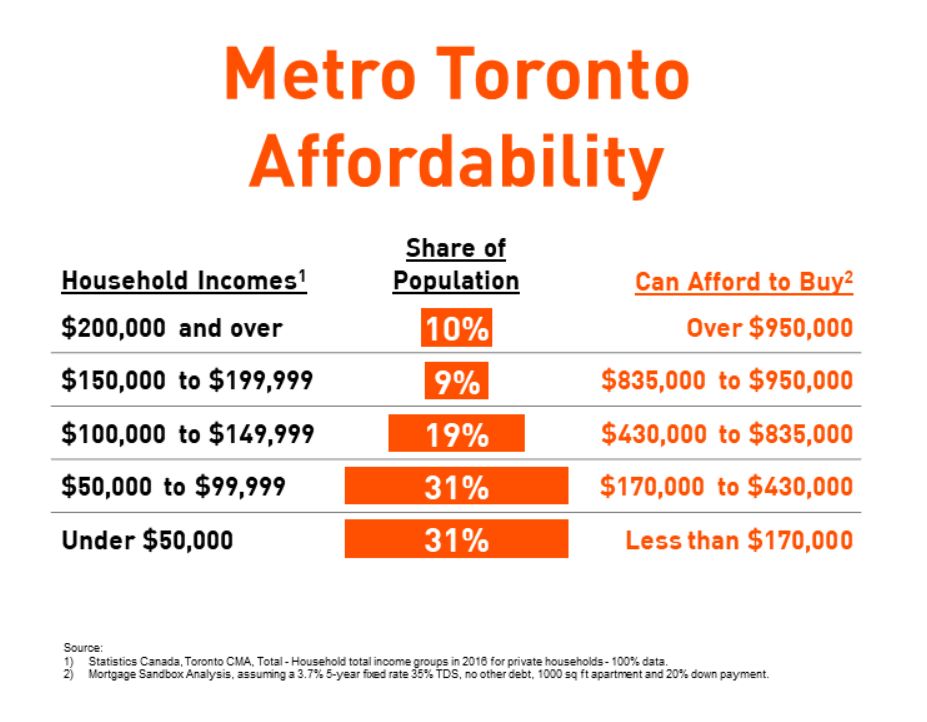

Metro Toronto Buyers Check Out Affordability

Metro Toronto Buyers Affordability to buy residential properties are determined based on:

Home Prices: The current market value of the desired home.

Savings-Equity of Buyers: How much disposable after-tax income you’ve been able to squirrel away plus any equity you have in your existing home.

Financing: This is driven by income levels (i.e., how much money you can put toward mortgage payments) and interest rates (how big are the mortgage payments).

How the above Affordability factors have changed lately in Metro Toronto:

Home prices: Prices are still 5 to 20% lower than the peak in 2017 depending on where the home is located and what type of home it is. Of course, lower prices improve affordability and add upward pressure on prices. However, given that prices are still very high, the current price drops aren’t making homes that much more affordable.

Savings-Equity: With rents rising faster than incomes, first-time buyers will struggle to come up with down payments and since homes prices have dropped most homeowners will have less home equity going in 2020 than they did in 2018.

Financing: Median incomes have not changed materially but mortgage qualifying interest rates dropped about 9% since 2018.

Lower interest rates are a major factor driving home prices. Although most forecasts predict mortgage rates will rise in 2020 the federal government recently reduced mortgage qualifying rate so that Canadians can borrow 3% more on their mortgage. 3% more debt isn’t a game-changer but, all other things being equal, it will allow prices to rise by up to 3%.

Over the course of 2019, affordability has improved which will add some fuel to home prices coming into 2020. Prices are still beyond the reach of a median Metro Toronto household with an income of $78,000 (before taxes) and in 2020 mortgage qualifying interest rates are expected to rise, so we expect affordability to suffer toward the end of 2020 and this would put downward pressure on prices.

In March, 2020, The Bank of Canada reduced the bank interest rate by 1% on emergency basis. The Canadian economy could face economic recession from the effects of lower oil prices and the Canadian population encountering serious health problems from the pandemic coronavirus (COVID 19).

Source: Mortgage Sandbox

============================================================

Thinking to sell your house or Condo in Central Toronto areas and/or in downtown Toronto areas? Please visit http://www.TorontoHomesMax.com for a FREE Home Evaluation“ or please call, text or email Max Seal, Broker at 647-294-1177. NO obligation.

Thinking to buy a House or Condo in Central Toronto areas and/or in Downtown Toronto areas? please call or text Max Seal, Broker at 647-294-1177 to buy your dream home or Condo. I offer you a 30-min “FREE buyer’s consultation” with NO obligation.

Please visit my website http://www.centraltorontorealestate.com/ to find out available homes and Condos for sale in Central Toronto areas and/or in downtown Toronto areas.

This Toronto housing market may be a better time for “Move-up”, “Move-down” or “Empty-nester” Sellers and Buyers. Want a “Market Update” of your home in 2019? Please click the image below or call or text Max Seal, Broker at 647-294-1177 or send an email.

Leave a Reply